Portfolio Performance Measurement Continued: A Plea for Actionable Metrics

There is nothing wrong with looking in the rearview mirror. It is necessary. The obvious nuance is it should not be the only thing you do as you drive your car down a busy road. Two insights broaden the view of metrics. Continuing the car analogy: it is not just the roads, or the other cars around, but also the speedometer plus a mindful eye on any blinking red lights trying to warn you of a future car failure. These first two insights can lead to a more holistic understanding of portfolio performance.

With such a wide set of metrics to choose from comes the next challenge: what should we focus on? How to use them to effect?

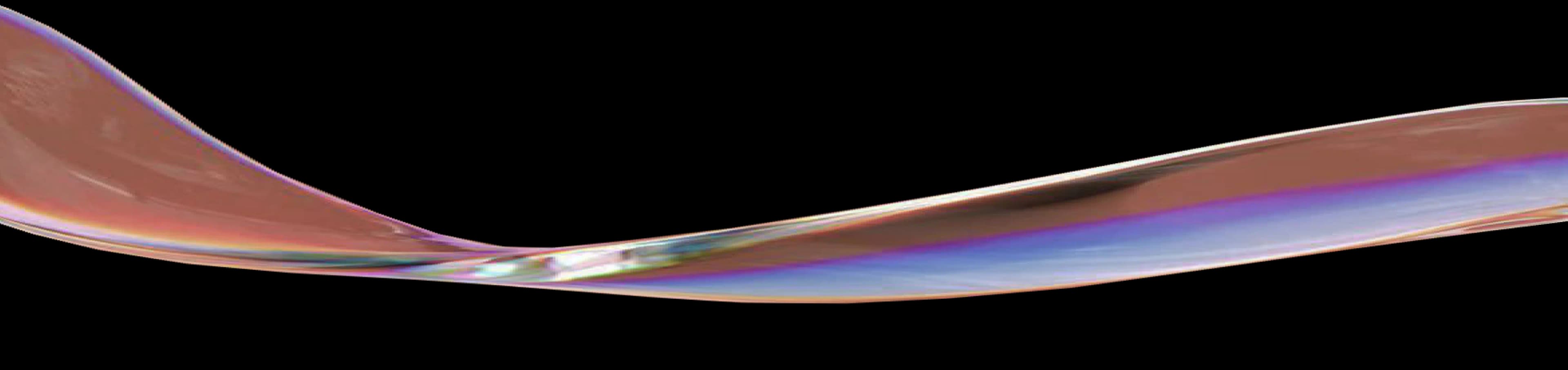

Insight 3: leading indicators for actionability.

If you’re new to this distinction in metrics, you’re in for a treat. The analytical mind does not want to stop in forming the causal effect relationships that leading and lagging indicators describe. But most importantly: this enables you to define actionable metrics where many current systems fall short.

Lagging indicators are retrospective metrics or data points that measure past performance or outcomes. Leading indicators are metrics or data points that provide early insights often used to anticipate and make proactive decisions before significant changes occur.

Whether to call an indicator more leading or more lagging depends on the readiness with which it can be measured. Best explained with some examples, we have added the figure below. When measuring initiatives, your leading indicators will give you substantial benefit. They serve as early warnings informing how likely your business case is going to be met along the way. And thus, allow you to pivot or stop the project altogether and minimize cost exposure. For organizations, they provide feedback on the effectiveness of current strategies and form the basis of continuous. How to spot them? Start with a lagging indicator, let’s say customer satisfaction. Now ask: what would make this customer happy? How do I achieve that particular result? How does my organization or project contribute to that?

In a way, you could argue scope completion for a project indicates some level of benefit to the customer. In a B2B transaction with features and scope often being a part of the contract, it just might be so. But only on the short term. Customers ultimately want solutions; if expectations fall short no answer is as unsatisfactory as ‘works as designed’. Also, if your organization recommends an easier, cheaper, better way to achieve the same customer outcome, would you like to start an argument or lengthy approval process? Leading indicators are strongest if they approximate the intended outcomes as close as possible.

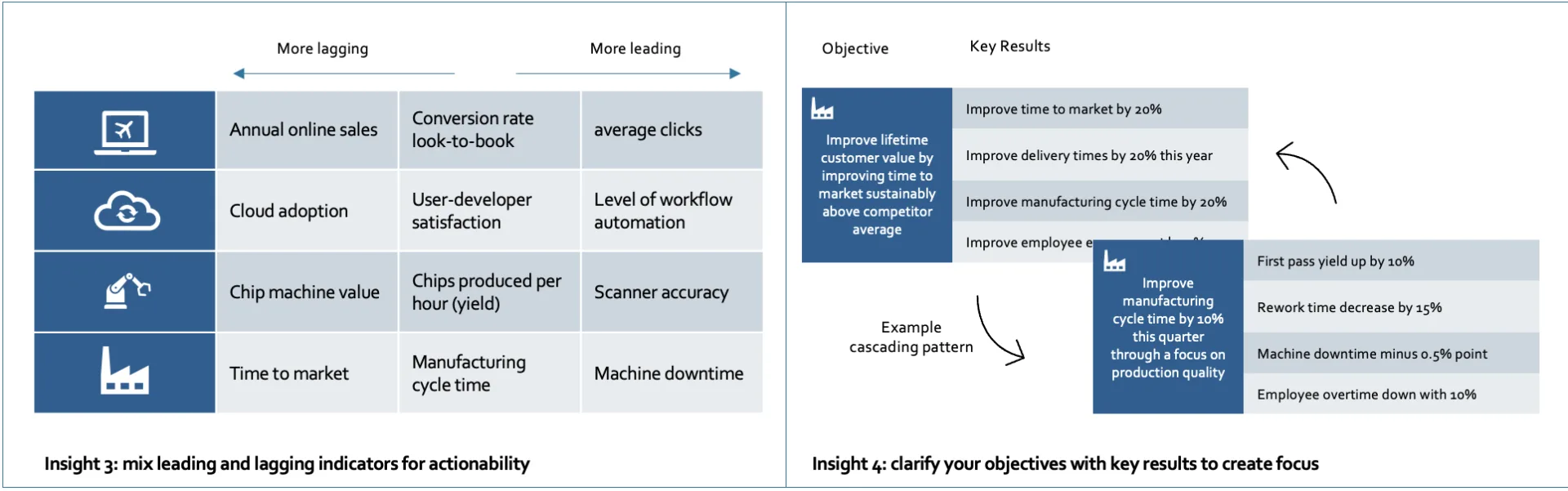

Insight 4: Focus on what really matters.

Apart from the full breadth of what should be measured (value, flow, compliance), our previous insight increased the number of metrics by a factor 2 easily. Rolled up to the portfolio this will overwhelm even the most seasoned data specialist. An obvious comfort is that not everything is to be rolled up to the portfolio, some metrics only apply to a certain (product) context. Yet there is another distinction to be made. One that allows you to focus where it matters most for an organization.

Based on the Management by Objective concept of Peter Drucker (“The Practice of Management”, 1954), Andy Grove in the 70s at Intel developed Objectives Key Results. An Objective Key Result is a specific, measurable, and time-bound metric that serves as a quantifiable indicator of progress toward achieving a specific goal for an organization. It is meant to be very different from ‘monitoring KPI’s’, also called health metrics. Back to the car analogy: the monitoring KPI’s are the dashboard gauges that keep you informed about your car's performance along the journey. By contrast, your Key Results are like your navigation system, showing you your destination and the in-between checkpoints, current positioning, and residual driving time between them. Key Results are not better than KPI’s, they are just different. In managing a business, it is about defining and measuring your aspirational goals (OKRs) while maintaining the essentials to keep your license to operate.

Widely publicized is the use of OKR by innovative companies in tech like Google. But now it has become a popular way to communicate and cascade strategic goals across companies regardless of industry. Air France – KLM, Amadeus IT Group and Shell all use OKR’s in different areas. By making your objectives measurable, you avoid confusion about their meaning and focus the organizations effort. By cascading them from team to team you communicate the strategic intent to allow more autonomous decision-making. But most importantly in this context, once your portfolio team has agreed what the focus should be for them, it helps them identify the indicators that best match their ambition and help guide their decision making.

So now what?

Chances are the two insights above are not totally new to you. Some of the language used might help you position things a bit better and structure the conversations with your team around measurements. Ultimately, they can help you create a metrics dashboard that better fits your needs helping you communicate the value of your portfolio and identify risks that need your team’s attention. In commercial departments like sales, and operational environments like manufacturing, the use of metrics dashboards is widespread. Not so much so for product engineering and development organization, which traditionally focused on and measured by project completion. In our next and final blog on portfolio measurement, “The CIO: Central Intelligence Organization” we will describe some early steps to secure and take advantage of portfolio measurement in your organization.

Related Insights