Budget approved: Why still fight for priority

Did you ever feel the frustration of having all the necessary budget approvals but still having to defend yourself before your agile-embracing department will finally spend time on it? Program and project managers, strategy managers and business executives who are dependent on others for execution will recognize this frustration. It’s one thing having to defend yourself to the investment committee or even to the CEO to get your strategic business case approved. It’s something else entirely if that victory to a seemingly uphill battle only gets you into another, even murkier one. You’d be glad to hear you are not alone. We have many anecdotes like these. For all the reported benefits of the agile way of working, this side effect is rarely considered enough.

The solution, though, is not to return to the old ways of working. It’s not the agile way of working itself that is to blame. And though we don’t really know you, we assume you’re not to blame either. Neither is your investment committee nor your CEO. Lingering for too long in a hybrid agile-waterfall system might be. If you bought the first line of this paragraph, this leaves only one option: shift the way you look at how you treat the budgeting process in the first place. From funding programs and projects to funding people and assets instead. With a possibly unexpected side-benefit: humanizing our workforce again.

A necessary shift when talking budgets

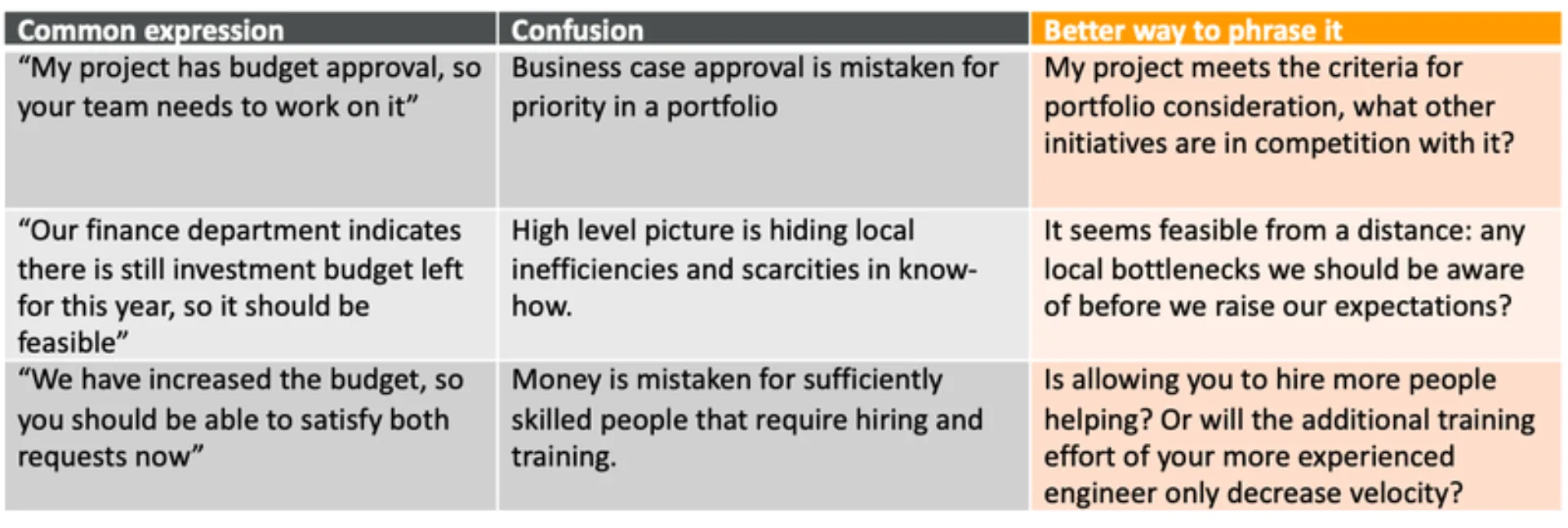

It starts with distinguishing project investments and related budgets from resource funding. Funding resources like assets or using funds to attract brains is at the very least a medium-term commitment. Investment policy expressed in budget plans, on the other hand, should be able to change rapidly based on context: a critical technology was not as mature as foreseen or a competitor move demands an immediate response. Yet especially in knowledge-intensive domains like digital development, it surprises us how many managers almost indiscriminately use the two as they talk about budgets. The resulting common confusion (see table: common pitfalls when talking about budgets in ‘delivery-agile’ organizations) downstream in the organization results in frustration and, worst case, inertia.

You should realize that in fact your journey is only halfway when the business case is approved. In an agile system with mostly stable teams, what you have actually gotten upon board approval is the acknowledgement your initiative is worth pursuing. The speed at which it ought to be pursued is entirely dependent on lots of other factors. Most notably: similar high-stakes initiatives that compete for the same people and resources. And that’s why it is ultimately in the company’s best interest to avoid assigning priority for large programs too early in the process. Decentralizing judgement on trade-offs promotes an MVP mindset and a keeping options-open strategy[1]. If your investment policies can change rapidly, it becomes clear traditional project budgeting is not the appropriate way to fund an organization as the instability will be too great. It is critical to understand the difference between project/program plans and resources that are the capacity to deliver. The work is to be managed, capacity (people and assets) to be funded.

Organizational implications

From a business controller’s point of view, the above way to look at costs simplifies a great deal. The cost of people and assets is relatively stable compared to the costs arising from the unpredictable nature of projects. It doesn’t come easy though. We identify 4 major implications:

1 Changing the role of the business case. As mentioned, instead of being that vehicle to ‘buy priority’ it becomes more like an entry criterium to the portfolio backlog. This will be a mindset change to managers used to getting their way.

2 IT skills are no longer to be centralized in a cost center. Yes, IT skills are special and managing developers might well justify equally specialized reporting lines. But that should not stop you from seeing them as value-adding units for a particular line of business. Instead, group revenue streams with their total people and operating cost together in value streams.

3 As accountability shifts to the business, control measures need to evolve. In many companies, the investment process serves as the Checks and Balances office of the company. And both parties to the table learned to play their roles. Business managers go to great lengths to get to a ‘yes’[2], leaving to the controllers the job to challenge the critical assumptions which might be carefully buried under lots of data. As greater decision-making power is decentralized to business portfolios, performance evaluation criteria (P&L, KPIs, OKRs) need to match it as much as possible.

4 Financial requirements, like CAPEX/OPEX, need to evolve. The project budgeting system has been there for so long, overturning it also disrupts many financial processes. In our view, such processes should always follow the business logic but be carefully considered.

Surprisingly, all this leads to another side effect. Start seeing your talented employees as they are: assets to the company. In certain financial investment circles already there’s an acknowledgement of a talent-centered approach to corporate value creation[3]. With extremely tight labor market conditions for IT talent, the additional attention associated with it will be more than welcomed by HR.

Where to start?

Before answering this question, it is important to state that the shift in thinking of funding value streams over managing budgets is just one aspect of lean budgeting. To truly become an agile company, with the ability to quickly adapt to rapidly changing customer needs and keep up with technology, a lot more is needed. The budgeting process needs to be dynamic, rather than fixed for the year. The strategic planning process, giving rise to the initiatives discussed, should be considered more as a journey rather than a plan to blindly execute. And as a result, companies need to spend more time creating short-cycled feedback loops from promise to proof at every level.

Then again, there are some simple steps to take after creating the necessary awareness among the finance and investment teams. These help you gain better hold on ‘why and when’ your initiative gets the deserved attention of the delivery teams. In the same order as the organizational implications are described, a relatively easy first step is to change the role of business cases. It does much to help avoid the common pitfalls when talking of budgets in the process. Budgets can be ‘pooled’ by the portfolio to save non-value-adding discussions at different organizational levels. A common second step is the identification of the value streams in the organization. More meaningful combinations of teams grouped in value streams, even if still virtual, helps everyone understand how value is created. It further minimizes dependencies that cloud the bigger picture. The next steps are to align the flow of accountability with the value stream structure and establish and implement alternatives to the financial requirements. Given the complexity of these, it is best to not go big bang here. Rather, have the two systems run parallel next to each other but with a shared understanding of the future transformation need. Starting with a small scope should build the confidence of all involved, not least those executing or sponsoring high-stakes initiatives.

Quick recap

A quick recap:

- Implementing only ‘delivery-agile’ has a high chance of blurring expectations created when holding onto existing ways of budgeting

- in such organizations, common pitfalls when talking of budgets will cause lots of frustration and even inertia

- The first shift in thinking is to fund capacity (stable teams of people and resources) and manage their workload, instead of the other way around

- This allows for increased portfolio agility, decentralizing judgement on trade-offs both having a strong potential to increase value

- But such a shift will have 4 major implications for financial and investment processes

- Any further implementation of agile beyond the delivery unit will need to find their organization-specific answers to these implications

- Take an incremental learning approach: experiment on a small scope, adjust as needed and expand your reach as confidence grows

Highberg offers consultancy and training on the above.

[1] Rita Gunther McGrath, 2013; The End of competitive advantage. Harvard Business School Press

[2] Bradley, Hird, Smit, 2018: Strategy beyond the hockeystick. John Wiley & Sons Inc

[3] Mckinsey.com

Related Insights