Organic or acquisitions – which growth is more effective for media companies?

"Anyone who does what they can already do, always remains what they already are." This quote from American automotive pioneer Henry Ford is more relevant than ever. Today, innovation and investment are required. Growth is not just an option, but a necessity for media companies.

Make strategic opportunities visible!

What opportunities arise in the extended environment of your core business? Where are growth opportunities, both organic and inorganic? What requirements do your markets have today and in the future? At the beginning of a growth strategy, the analysis of the market, competitive environment and customer behavior is crucial. It is essential to identify the most attractive markets and potential areas for you. Ideally, this identification of potential fields for your new business is based not only on a classic market analysis but also on the best practices of your industry and your entrepreneurial strengths—the so-called "unfair advantages". By combining these aspects, a suitable long list of potential fields is created for your company.

Evaluate the opportunities based on market and strategy fit!

Which potential fields fit best for your company? Which opportunities should be seized first? The selection is not easy—an attractive potential field close to the core business meets the following criteria, among others:

- Focus on investment in a sustainably growing business ("Rule-of-x"): The "Rule-of-x" states that the growth rate and profitability of a potential field together should exceed more than x per cent. This rule is used as a benchmark for success and sustainability by investors and companies alike and is an established metric in the M&A field

- Dockability to existing activities: Take advantage of the core business to build competitive advantages, synergies and scale effects

- Calculability of entrepreneurial risk: Does the potential field allow a "fail fast, fail cheap" approach? The idea behind it is to act quickly, experiment and find out what does and does not work before providing more investment resources

Determine the right implementation path!

Finally, the question arises of how to actually implement the strategy. The appropriate implementation path of a growth strategy depends entirely on the conditions of your company. It may make sense to grow organically, that is, on one's own, in one potential field and inorganically in another. Companies can often achieve growth goals more effectively and quickly through acquisitions or mergers. Organic growth without such transactions, on the other hand, is increasingly reaching its limits.

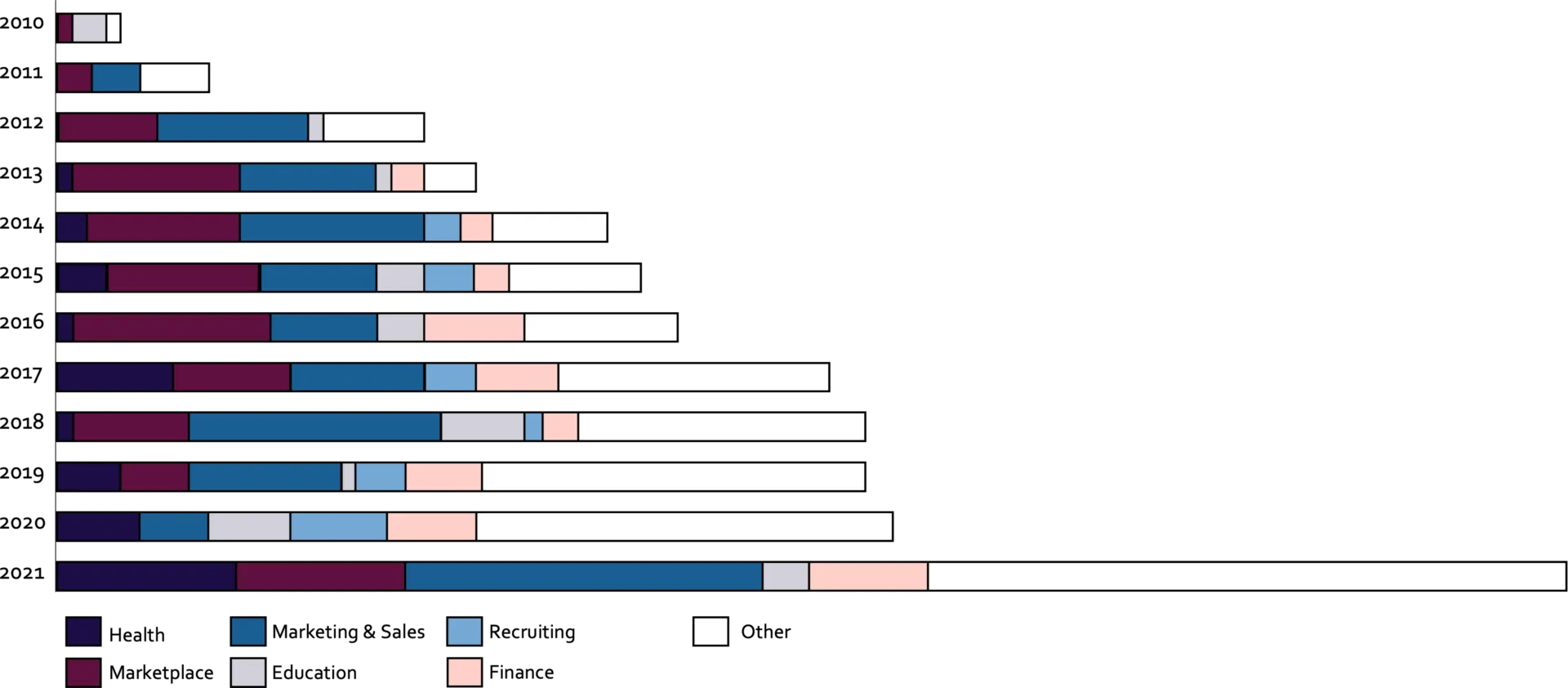

This is also confirmed by analyses, which have observed a continuous increase in venture capital investments in the media environment. For example, the number of investments has doubled in the peer group examined since 2019, despite the pandemic. The illustration below shows the number of investments in selected potential areas over time.

This trend of inorganic growth puts pressure on the medium- to long-term competitiveness of companies that have not yet developed a comprehensive growth strategy or face significant challenges in its implementation. If support is needed in optimizing your growth strategy, identifying and evaluating growth potential or implementation, or if you have any further questions, please feel free to contact us.

Related insights